Speaking with Cliona O’Dowd from The Australian recently, Talaria CO-CIO Hugh Selby-Smith talked about how the set and forget investment strategy mindset that has served investors reliably over the past 30 years will not succeed in a world backing away from globalisation.

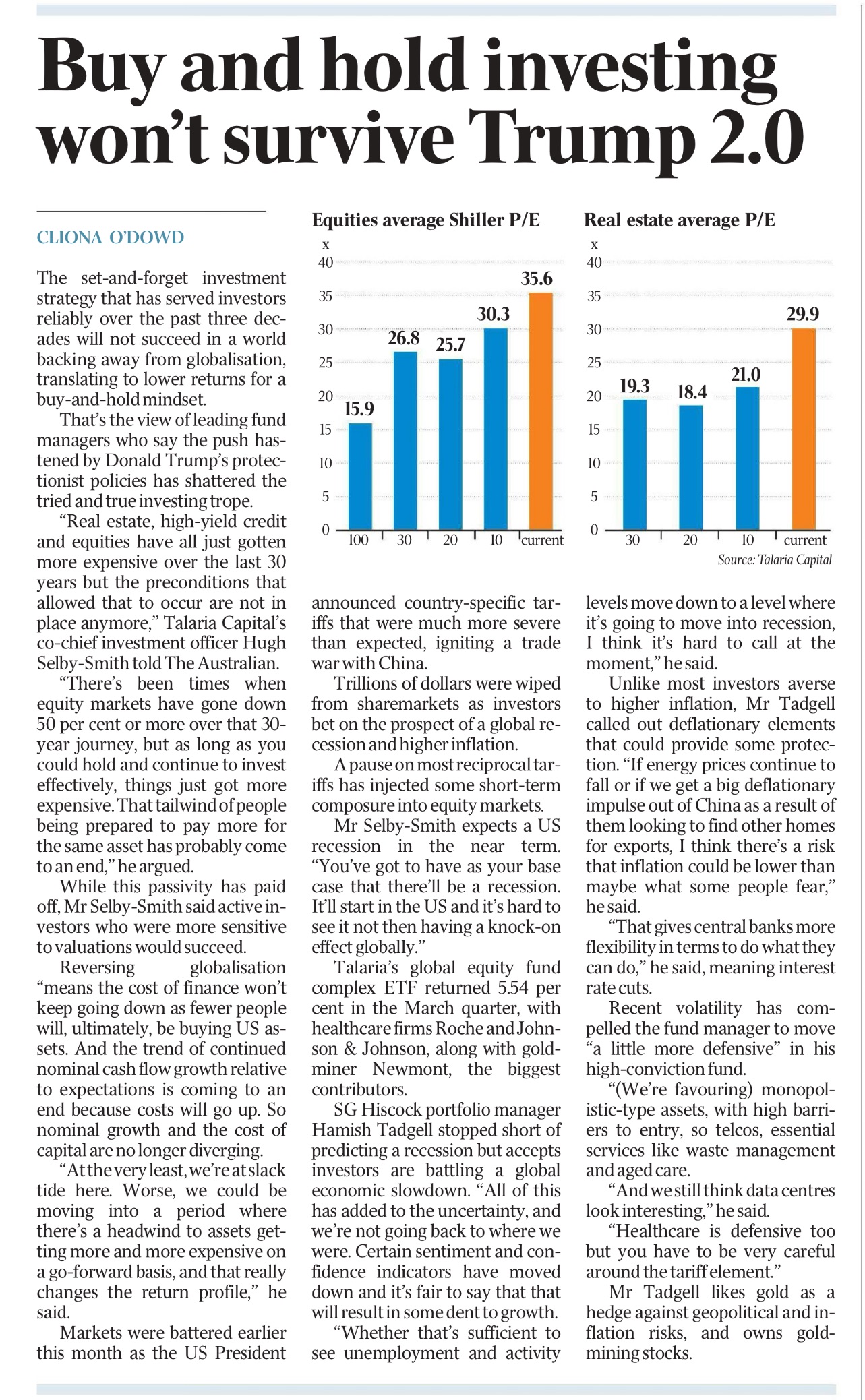

“Real estate, high yield credit and equities have all just gotten more expensive over the last 30 years but the preconditions that allowed that to occur are not in place anymore,” Hugh said.

Reversing globalisation “means the cost of finance won’t keep going down as fewer people will, ultimately, be buying US assets. And the trend of continued nominal cash flow growth relative to expectations is coming to an end because costs will go up. So nominal growth and the cost of capital are no longer diverging.”

Read the full article in The Australian.