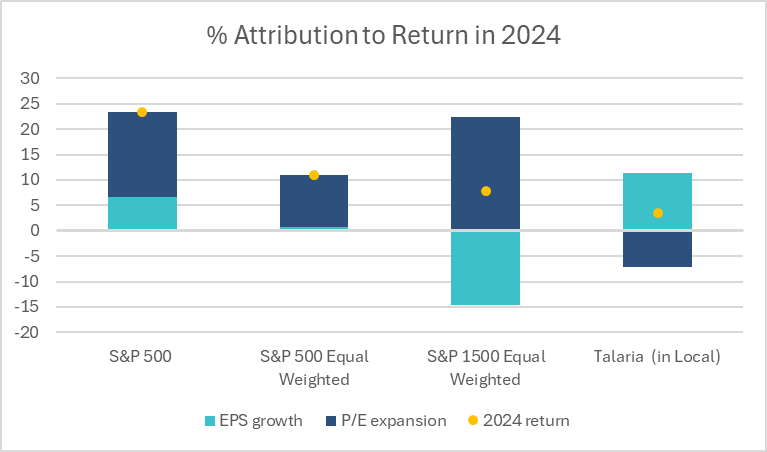

The recent surge in US equity markets, particularly the S&P 500’s 23 per cent increase in 2024, is largely due to valuation expansions. This has created significant risks for investors, as these expansions are arguably not justified and in turn exposes them to a greater risk of a paying too much for shares that may fall in value over time.

Early in 2025, the risks are in plain sight. The chart below shows that while 7 per cent earnings per share (ESP) growth contributed to US share market gains last year, the much larger driver of rising share prices was an expansion in valuation multiples, as investors were willing to pay significantly more for each dollar of companies’ sales or earnings.

Read the full article in Adviser Voice.

Source: Talaria, Bloomberg. Talaria return is only local performance of gross capital at risk of holdings as of 31 December 2024 for illustrative purposes.