An income fund is any type of fund (e.g. mutual fund or exchange-traded fund (ETF)) that prioritises income in the form of distributions either on a monthly or quarterly basis, as opposed to funds that just target capital gains or appreciation. Such funds usually hold a variety of government, municipal, and corporate debt obligations, preferred stock, money market instruments, and dividend-paying stocks.

The Importance of Income in Total Return

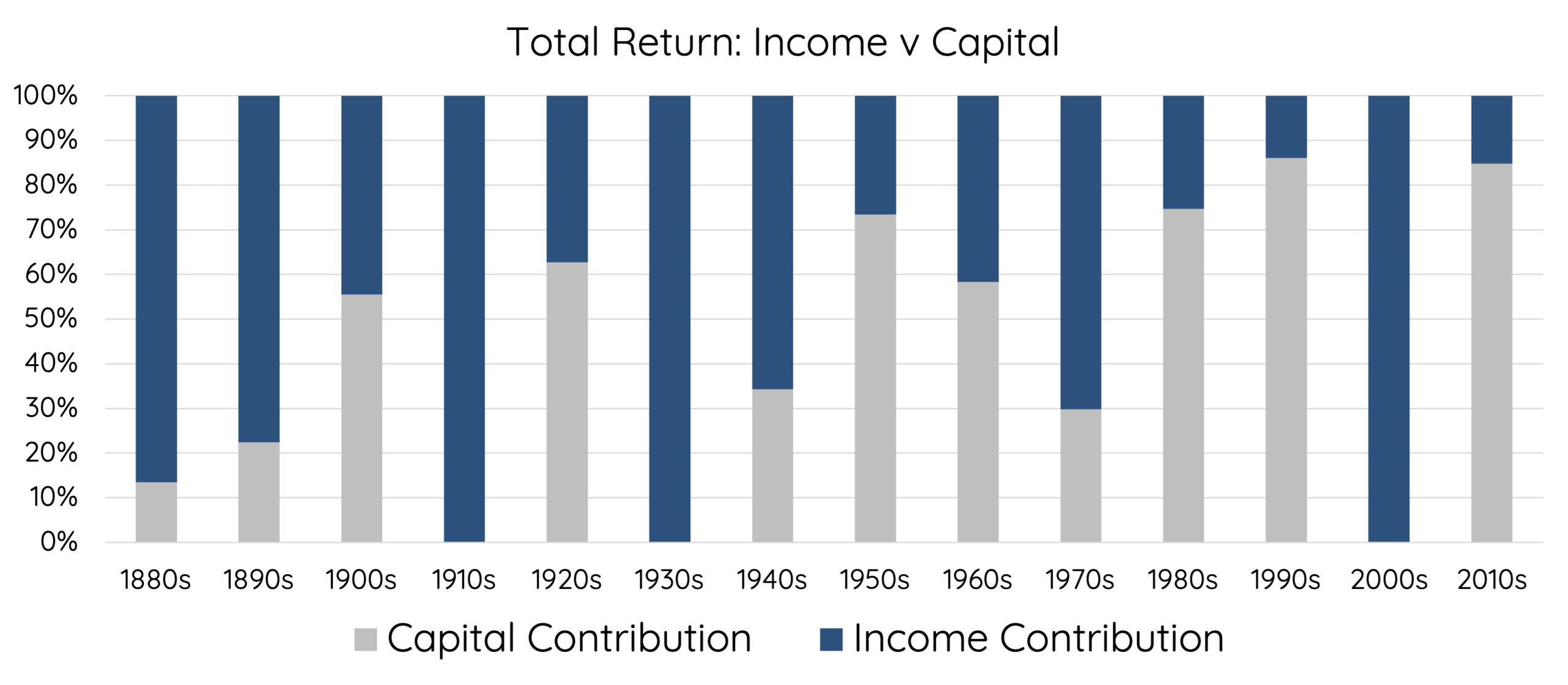

Income can be a critical component of total return. In the US there have been periods, such as the 1910s, 1930s, and 2000s, where all investor returns came from income alone.

Source: S&P

While the data above is for the S&P500, the ASX is no different. Between 2007 to 2020, all returns for investors in the ASX were from income, despite significant market events like resource and housing booms.

Finding the Best Income Fund

Finding the best income fund can be a tricky task. As always investors should begin the process by considering their specific circumstances. The two primary sources of income are dividends from equity investments and interest income from cash or bonds. However, both have their risks:

Dividends

While dividends can provide a reliable income stream, they are not guaranteed. During economic downturns, companies may cut dividends to conserve cash, as seen during the COVID-19 pandemic. Over-reliance on dividends can also lead to a lack of diversification, particularly if investors focus on high-dividend sectors like banks and resources in Australia.

Interest Income

Interest rates can be highly volatile. For example, in August 2008, the RBA cash rate was 7.25%, but by the following year, it had dropped to 3.00%. This volatility makes it difficult to rely on interest income for a stable return.

The Income Engine: A Diversified Solution

At Talaria, our unique implementation process that uses put options to enter stock positions, generates consistent and differentiated premium for our investors. The premium, whether taken as income or used to reduce our stock entry price offers several benefits:

- Consistency: Provides a steady income stream that is not dependent on market conditions or company decisions.

- Risk Management: Creates a buffer against losses and reduces portfolio volatility.

- Diversification: Offers a source of return that is not correlated with traditional income sources.

The other feature of such a strategy, unlike dividends and interest, is that it is priced off volatility. The higher the uncertainty about the future, the higher the premiums we collect to compensate for that uncertainty.

In the current economic environment, characterised by high starting valuations, inflation, and the impacts of monetary policy, having a consistent and diversified source of income is invaluable.

Conclusion

Income plays a vital role in achieving a balanced and resilient investment portfolio. By focusing on generating income through a diversified mix of assets and innovative strategies, investors can achieve stable returns even in volatile markets. For more insights and detailed information on our strategies, visit our Media Hub and explore our articles on having income options and dividends and income.