To celebrate the 500th Edition of Firstlinks, they asked a group of about 30 fund managers to consider their entire investment process and drill down into what drives the most success.

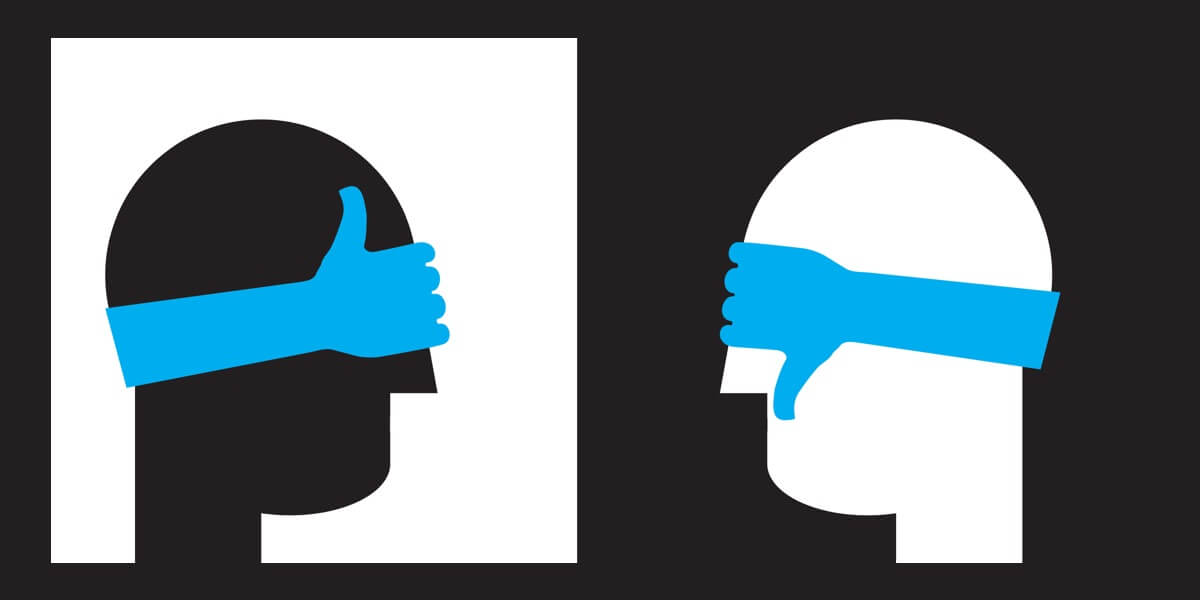

In his section Talaria Co-CIO Chad Padowitz focusses on recognising the market’s behavioural biases, noting that “behavioural biases can negatively impact stock selection and therefore the likelihood of picking winners. It is often the biases, whether conscious or not, that stand between strong fundamental skills and a good investment performance.”

“An example is that we do not meet company management as this can impose confirmation and authority biases. A positive forward growth story delivered by an influential and successful CEO or CFO can lead to a very appealing narrative for investors to buy into but can relegate the fundamental data to a lower level of importance for the analyst who is researching.

We do not have biases to sectors or regions and we are not led by a theme or ‘flavour of the day’ story. Moreover, our investment team is relatively small, with only six people. A large team can often lead to group think which amplifies rather than alleviates biases. Finally, our holding period is on average three years, reducing the risk of overtrading, that is often costly, distracting and short-sighted. When we combine rigorous bottom-up analysis alongside these important ways to reduce potentially damaging biases, we greatly improve our ability to identify winners,” Chad said.

Read the full booklet here, with Chad’s section on page 9.