Our outcomes

Talaria Global Equity Fund Complex ETF

Cboe: TLRA/TLRH

)

)

For equity investors, income forms the bedrock of total returns from Australian shares and accounts for roughly half of the total returns delivered by global shares (S&P500 since inception). However to receive it, investors are exposed to the business cycle and reliant on a company’s ability and desire to pay dividends. But what happens when some of the biggest companies in the market either reduce or don’t pay dividends?

The Talaria Global Equity Fund Complex ETF offers Australian investors high levels of consistent income from a differentiated source, which it has been distributing on a quarterly basis for over 15 years.

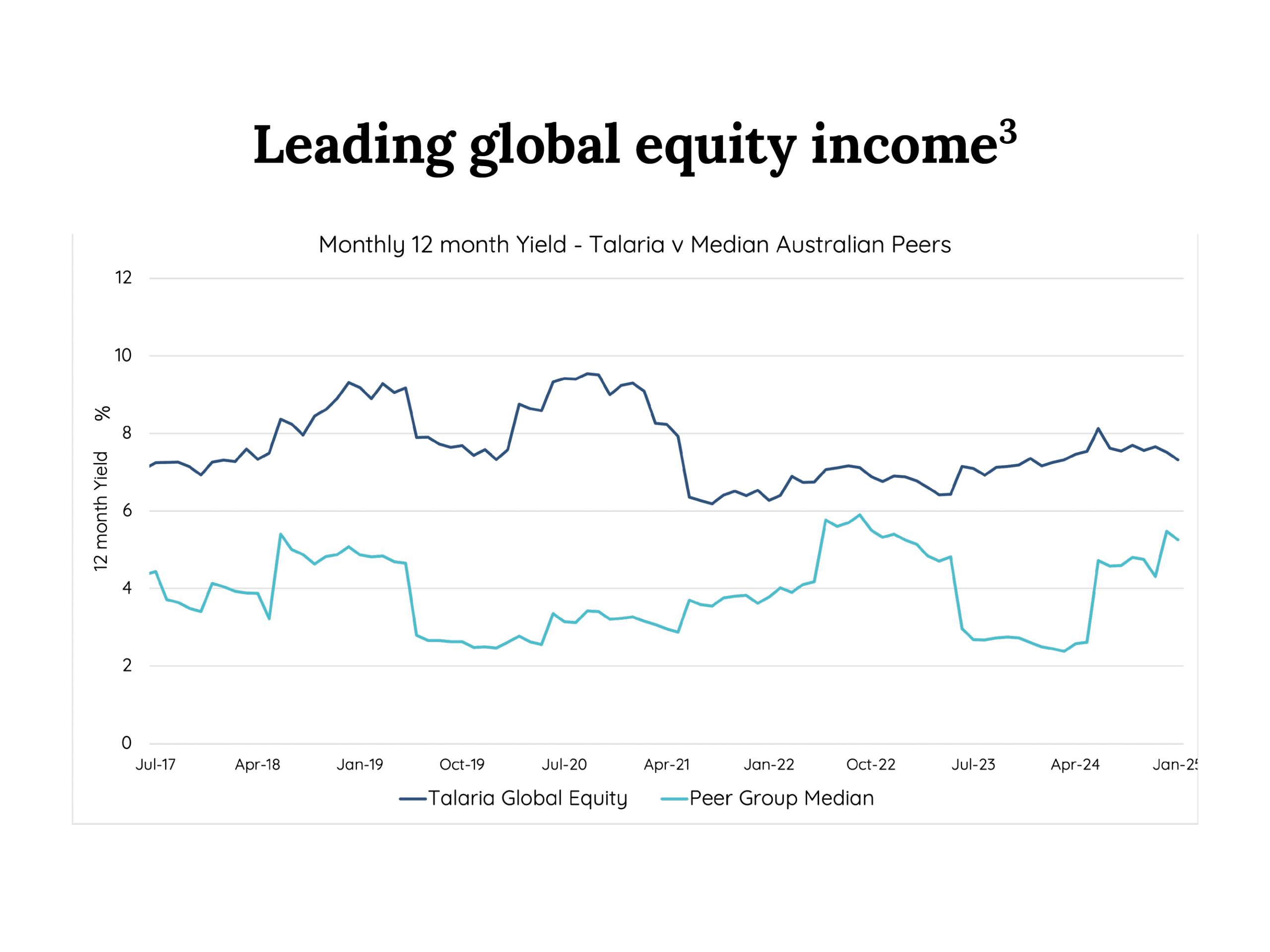

The Talaria Global Equity Fund Complex ETF’s unique process, creates income that is consistently higher than the median of its Australian based global equity peers.

You can find out more about how this is done in the video below.

Hear from WCA Wealth Management about how they and their clients use and benefit from Talaria’s high levels of consistent and differentiated income.

Talaria’s unique investment process has resulted in the strategy delivering significantly less drawdowns in weak markets since inception. Losing less in down markets means investors have more money working for them in the upturn, leading to more consistent and sustainable investment returns over time.

Rule number 1 ‘don’t lose money’, rule number 2 ‘don’t forget rule number 1.’

Talaria’s unique investment process means it has significantly less drawdowns than the market since inception, meaning investors have more money working for them in the upturn, leading to more consistent and sustainable investment returns over time.

Footnotes

1,2 Source: Talaria Global Equity Fund Complex ETF as at 31 January 2025 and 31 December 2024

3 Source: Morningstar, September 2017-January 2025. Peer group is Australian based active global equity funds, 12 month yield.

4 Source: Morningstar, 3 years to January 2025

5 Source: Morningstar, 3 years to January 2025

6 Source: Morningstar, 3 years to January 2025

Important Information

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Talaria Global Equity Fund Complex ETF (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This webpage has been prepared by Talaria Asset Management (Talaria) to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Talaria, Equity Trustees nor any of its related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.

Talaria Global Equity Fund Complex ETF’s Target Market Determination is available here. A Target Market Determination is a document which is required to be made available from 5 October 2021. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

The rating issued 05/2024 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2023 Lonsec. All rights reserved.

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned November 2024 for funds AUS0035AU and WFS0547AU) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.